Article 2 in a series gleaned from Growth to Good conversations and research.

Does your business think about stock like shelving?

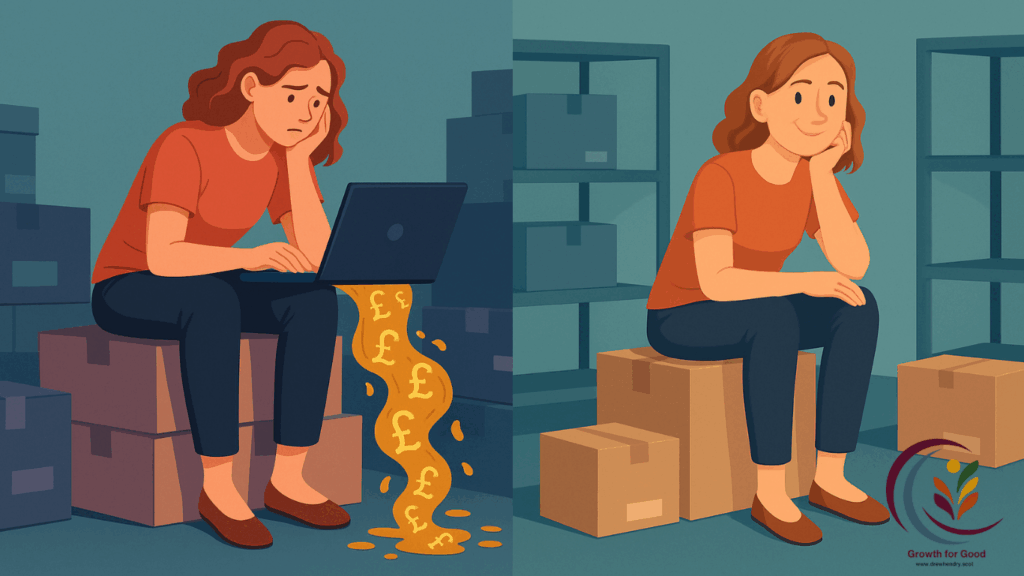

Is it something to count, manage, or hope gets sold? But that way of thinking misses the bigger picture. Stock isn’t just sitting there. It’s one of the most powerful forms of capital in your business. It’s either helping you grow or quietly draining your resources.

In the last Growth for Good insight article, we talked about how growth isn’t free. This one flips that around and looks at how growth might already be sitting on your shelves, waiting to be unlocked. And the best part? You don’t need to raise a single invoice to start. That could be a very profitable place to start growing.

Stock is cash on pause.

That product you see sitting in storage? That’s money you can’t use for anything else. You’ve already paid for it, whether upfront or on credit. Until it sells, that cash is frozen.

Ask yourself this. If you wouldn’t tie up ten grand in unused office chairs, why do it in stock that just sits there?

Stock Isn’t Storage. The goal is to keep your stock moving. It should cost less to hold, support your cash flow, and fuel your business. Not hold it back.

Stop guessing. Start forecasting.

Throughout my business career, I’ve seen many businesses make decisions based on gut feel or panic. At Electrolux, we had to embrace a complex system of just-in-time ordering, and, almost all of the time, it worked. But even basic forecasting can make a huge difference. It turns stock from a gamble into a smart part of your growth plan.

Try this: build a rolling three-month demand plan. Check in every month. Look at how quickly products are selling, not just how many.

For example, if you sell 100 units a month but have 400 in stock, you’re sitting on three months’ worth of cash. That’s money tied up for no good reason.

Group your stock by value, not by where it sits.

Not all stock deserves the same attention. Try a simple ABC approach.

A-items are high value but don’t sell in big volumes. Keep a close eye on these.

B-items are middle of the road. Balance how much you hold with how fast they move.

C-items have a lower value but sell quickly. Automate reordering to save time.

Spend more time managing what matters. If your focus is on A-items, you’re more likely to improve your bottom line. These are the products that can really move the needle.

Review slow stock every quarter.

Throughout the Growth for Good journey, I have heard from business owners across the Highlands and Islands about the value of getting into rhythms, which is good advice for stock. Dead stock is more than just wasted space. It’s a missed opportunity, so a good rhythm to get into is to check every three months what hasn’t moved.

If it’s just sitting there, do something about it. Discount it. Bundle it with a popular item. Donate it and see if there’s a tax benefit*

If stock isn’t paying its way, it’s costing you. Stock Isn’t Storage after all.

Work with your suppliers, not just around them.

Suppliers aren’t just where you get your stock. They can help you manage it better too. Build stronger partnerships.

Consider requesting flexible minimum order sizes. Explore vendor-managed inventory. Share your forecasts or give them access to a dashboard.

The more agile your supply chain, the easier it is to scale. A rigid one will hold you back.

Use tech that pays for itself.

You don’t need to invest in fancy enterprise software. But if you’re still managing everything on spreadsheets and guesswork, you’re likely ordering too much or too little. Both cost you.

Look for simple systems that can pay for themselves within a year. That could be through better stock turnover, fewer out-of-stock moments, or reducing the number of items you have to write off.

Stock is not just stuff. It’s a strategy.

When you start seeing stock as capital instead of clutter, everything changes. You make sharper decisions, keep your cash moving, and create smoother operations. Stock Isn’t Storage.

It’s not about doing more. It’s about being smarter with what you already have.

You can find a detailed research article here

*I don’t give tax advice!